Analysis for the Business Channel

Maks Nikiforov and Mark Austin Due 10/31/2021

##For markdown automation need a different

## image and cache folder

## for each of the 6 channels so that results

## from different channels don't overwrite each other

##Also setting up currentChannel variable

if (params$channel=="data_channel_is_bus") {

knitr::opts_chunk$set(fig.path = "images/bus/",

cache.path = "cache/bus/")

currentChannel<-"Business"

} else if (params$channel=="data_channel_is_entertainment") {

knitr::opts_chunk$set(fig.path = "images/entertainment/",

cache.path="cache/entertainment/")

currentChannel<-"Entertainment"

} else if (params$channel=="data_channel_is_lifestyle") {

knitr::opts_chunk$set(fig.path = "images/lifestyle/",

cache.path = "cache/lifestyle/")

currentChannel<-"Lifestyle"

} else if (params$channel=="data_channel_is_socmed") {

knitr::opts_chunk$set(fig.path = "images/socmed/",

cache.path = "cache/socmed/")

currentChannel<-"Social Media"

} else if (params$channel=="data_channel_is_tech") {

knitr::opts_chunk$set(fig.path = "images/tech/",

cache.path = "cache/tech/")

currentChannel<-"Tech"

} else if (params$channel=="data_channel_is_world") {

knitr::opts_chunk$set(fig.path = "images/world/",

cache.path = "cache/world/")

currentChannel<-"World"

}

Data Import

Data was imported first to allow for a more automated introduction.

# Read all data into a tibble

fullData<-read_csv("./data/OnlineNewsPopularity.csv")

# Eliminate non-predictive variables

reduceVarsData<-fullData %>% select(-url,-timedelta)

#test code for pre markdown automation

#params$channel<-"data_channel_is_bus"

#filter by the current params channel

channelData<-reduceVarsData %>% filter(eval(as.name(params$channel))==1)

# URL data for top ten articles in each category

channelDataURL <- fullData %>% filter(eval(as.name(params$channel))==1)

###Can now drop the data channel variables

channelData<-channelData %>% select(-starts_with("data_channel"))

Introduction

This page offers an exploratory data analysis of Business articles in the online news popularity data set. The top ten articles in this category, based on the number of shares on social media, include the following titles:

| Shares | Article title |

|---|---|

| 690400 | Dove Experiment Aims to Change the Way You See Yourself |

| 652900 | Kanye West Lectures at Harvard About Creativity |

| 310800 | It’s Hot as Hell in Australia Right Now |

| 306100 | BlackBerry Sold 1 Million BlackBerry 10 Smartphones in Q4 |

| 298400 | IBM Brings Watson to the Masses and Other News You Need to Know |

| 158900 | All The Christmas Movies You Need in One Mashup |

| 144400 | Can Beautiful Design Make Your Resume Stand Out? |

| 139500 | Apple to Return $32.5 Million for Accidental App Purchases |

| 110200 | How Big Data Is Influencing Hiring |

| 106400 | MapBox Enables Amazing Custom Maps for Sites and Apps |

Two variables - url and timedelta - are non-predictive and have been

removed. The remaining 53 variables comprise 6258 observations, which

makes up 15.8 percent of the original data set. Fernandes et al., who

sourced the data, concentrated on article characteristics such as

verbosity and the polarity of content, publication day, the quantity of

included media, and keyword attributes (Fernandes et al., 2015). A

subset of these variables and the correlations between them are explored

in subsequent sections.

The broader purpose of this analysis is predicated on using supervised

learning to predict a target variable - shares. To this end, the final

sections outline four unique models for conducting such predictions and

an assessment of their relative performance. Two models are rooted in

multiple linear regression analysis, which assesses relationships

between a response variable and two or more predictors. The remaining

models are based on random forest and boosted tree techniques. The

random forest method averages results from multiple decision trees which

are fitted with a random parameter subset. The boosted tree method

spurns averages in favor of results that stem from weighted iterations

(James et al., 2021).

Summarizations

Numerical Summaries

The first table summarizes information for article shares grouped by

whether an article was a weekend article or not. This summary gives an

idea of the center and spread of shares across type of day group

levels.

channelData %>%

mutate(dayType=ifelse(is_weekend,"Weekend","Weekday")) %>%

group_by(dayType) %>%

summarise(Avg = mean(shares), Sd = sd(shares),

Median = median(shares), IQR =IQR(shares)) %>% kable()

| dayType | Avg | Sd | Median | IQR |

|---|---|---|---|---|

| Weekday | 2975.514 | 15614.231 | 1300 | 1376 |

| Weekend | 3909.990 | 7563.786 | 2400 | 2400 |

The next tables gives expands on the idea of the first table by grouping

shares by each day of the week. This summary gives an idea of the

center and spread of shares across day of the week group levels.

dowData<-channelData %>% select(starts_with("weekday_is"),shares) %>%

mutate(dayofWeek=case_when(as.logical(weekday_is_monday)~"Monday",

as.logical(weekday_is_tuesday)~"Tuesday",

as.logical(weekday_is_wednesday)~"Wednesday",

as.logical(weekday_is_thursday)~"Thursday",

as.logical(weekday_is_friday)~"Friday",

as.logical(weekday_is_saturday)~"Saturday",

as.logical(weekday_is_sunday)~"Sunday")) %>%

select(dayofWeek,shares)

dowLevels<-c("Monday","Tuesday","Wednesday",

"Thursday","Friday","Saturday","Sunday")

dowData$dayofWeek<-factor(dowData$dayofWeek,levels = dowLevels)

dowData %>%

group_by(dayofWeek) %>%

summarise(Avg = mean(shares), Sd = sd(shares),

Median = median(shares), IQR =IQR(shares)) %>% kable()

| dayofWeek | Avg | Sd | Median | IQR |

|---|---|---|---|---|

| Monday | 3887.436 | 28313.186 | 1400 | 1651.00 |

| Tuesday | 2932.336 | 10826.650 | 1300 | 1387.00 |

| Wednesday | 2676.552 | 8160.413 | 1300 | 1312.00 |

| Thursday | 2885.192 | 13138.010 | 1300 | 1296.75 |

| Friday | 2363.770 | 5133.923 | 1400 | 1420.25 |

| Saturday | 4426.897 | 10139.138 | 2600 | 2150.00 |

| Sunday | 3543.784 | 4979.289 | 2200 | 2400.00 |

The table below highlights variables with the highest and most significant correlations in the data set. This output may be considered when analyzing covariance to control for potentially confounding variables.

# Display top 10 highest correlations

covarianceDF <- corr_cross(df = channelData, max_pvalue = 0.05, top = 10, plot = 0) %>%

select(key, mix, corr, pvalue) %>% rename("Variable 1" = key, "Variable 2" = mix,

"Correlation" = corr, "p-value" = pvalue)

# Display non-zero p-values

covarianceDF[4] <- format.pval(covarianceDF[4])

kable(covarianceDF)

| Variable 1 | Variable 2 | Correlation | p-value |

|---|---|---|---|

| kw_max_min | kw_avg_min | 0.976916 | < 2.22e-16 |

| n_unique_tokens | n_non_stop_unique_tokens | 0.905731 | < 2.22e-16 |

| rate_positive_words | rate_negative_words | -0.903109 | < 2.22e-16 |

| kw_max_avg | kw_avg_avg | 0.879080 | < 2.22e-16 |

| self_reference_max_shares | self_reference_avg_sharess | 0.866696 | < 2.22e-16 |

| kw_min_min | kw_max_max | -0.855276 | < 2.22e-16 |

| self_reference_min_shares | self_reference_avg_sharess | 0.810516 | < 2.22e-16 |

| global_rate_negative_words | rate_negative_words | 0.788070 | < 2.22e-16 |

| weekday_is_sunday | is_weekend | 0.749185 | < 2.22e-16 |

| avg_negative_polarity | min_negative_polarity | 0.745006 | < 2.22e-16 |

Contingency Table

The following contingency table displays counts and sums for the number of article shares within given ranges by the day of week shared. Share ranges were selected to illustrate lower, medium, and higher ranges of shares. Examining these counts can show possible patterns of shares by day or week and the range grouping for shares.

##dig.lab is needed to avoid R defaulting to scientific notation

kable(addmargins(table

(dowData$dayofWeek,cut(dowData$shares,

c(0,200,1000,10000,860000),dig.lab = 7))))

| (0,200] | (200,1000] | (1000,10000] | (10000,860000] | Sum | |

|---|---|---|---|---|---|

| Monday | 2 | 369 | 739 | 43 | 1153 |

| Tuesday | 2 | 422 | 714 | 44 | 1182 |

| Wednesday | 6 | 470 | 762 | 33 | 1271 |

| Thursday | 3 | 439 | 762 | 30 | 1234 |

| Friday | 5 | 232 | 582 | 13 | 832 |

| Saturday | 1 | 9 | 220 | 13 | 243 |

| Sunday | 0 | 26 | 300 | 17 | 343 |

| Sum | 19 | 1967 | 4079 | 193 | 6258 |

Plots

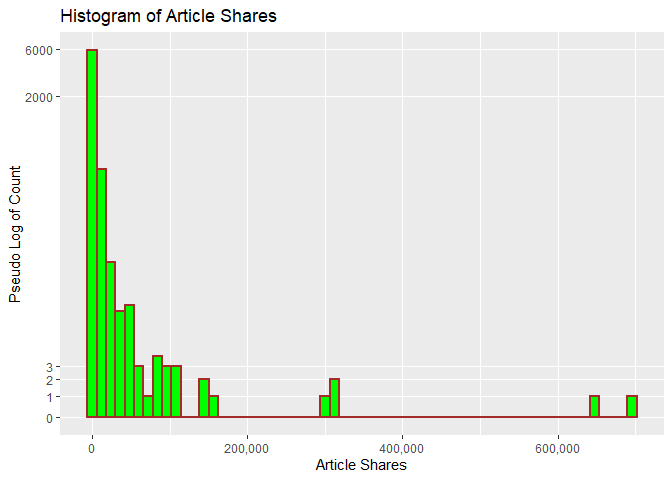

The following histogram looks at the distribution of shares. A pseudo

log y scale with modified y break values was used so that article

shares with low frequency will appear. We can tell from the histogram

whether shares has a symmetric or skewed distribution. The

distribution is symmetric if the tails are the same around the center.

The distribution is right skewed if there is a long left tail and right

skewed if there is a long right tail.

###creating histogram of shares data

##scales comma was used to avoid the default scientific notation

##pseudo log with breaks was used to make low frequency values

## more visisble

g <- ggplot(channelData, aes( x = shares))

g + geom_histogram(binwidth=12000,color = "brown", fill = "green",

size = 1) + labs(x="Article Shares", y="Pseudo Log of Count",

title = "Histogram of Article Shares") +

scale_y_continuous(trans = "pseudo_log",

breaks = c(0:3, 2000, 6000),minor_breaks = NULL) +

scale_x_continuous(labels = scales::comma)

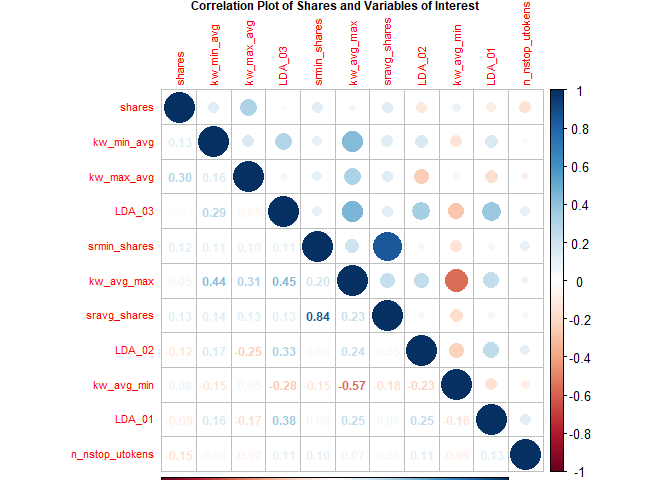

Fernandes et al. highlight several variables in their random forest

model (Fernandes et al., 2015). The following variables from their top

11 were included in the following correlation plot with variables in ()

being renamed for this plot:

shares,kw_min_avg,kw_max_avg,LDA_03,self_reference_min_shares(srmin_shares),kw_avg_max,self_reference_avg_sharess(sravg_shares),LDA_02,kw_avg_min,LDA_01,n_non_stop_unique_tokens(n_nstop_utokens).

The plot shows correlation with the response variable shares and the

other various combinations. Larger circles indicate stronger positive

(blue) or negative (red) correlation with correlation values on the

lower portion of the plot.

##Reduce variable name length for later plotting

## Otherwise var names overwrite Title no matter

## how many other size tweaks were made

corrData<-channelData %>%

mutate(sravg_shares=self_reference_avg_sharess,

srmin_shares=self_reference_min_shares,

n_nstop_utokens=n_non_stop_unique_tokens)

Correlation<-cor(select(corrData, shares, kw_min_avg,

kw_max_avg, LDA_03, srmin_shares,

kw_avg_max, sravg_shares, LDA_02,

kw_avg_min, LDA_01, n_nstop_utokens),

method = "spearman")

corrplot(Correlation,type="upper",tl.pos="lt", tl.cex = .70)

corrplot(Correlation,type="lower",method="number",

add=TRUE,diag=FALSE,tl.pos="n",tl.cex = .70,number.cex = .75,

title =

"Correlation Plot of Shares and Variables of Interest",

mar=c(0,0,.50,0),cex.main = .75)

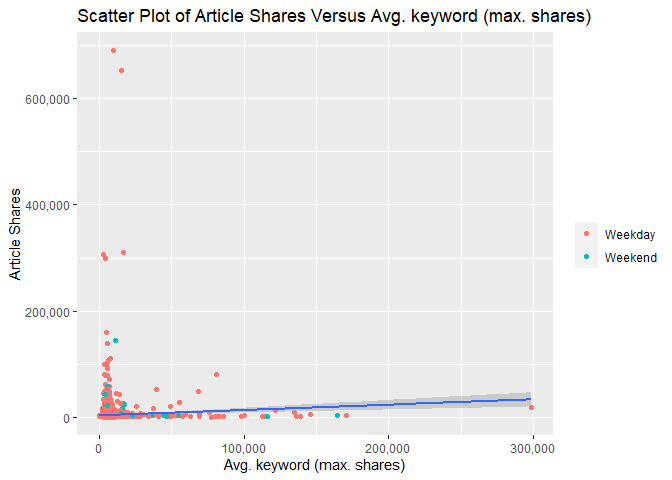

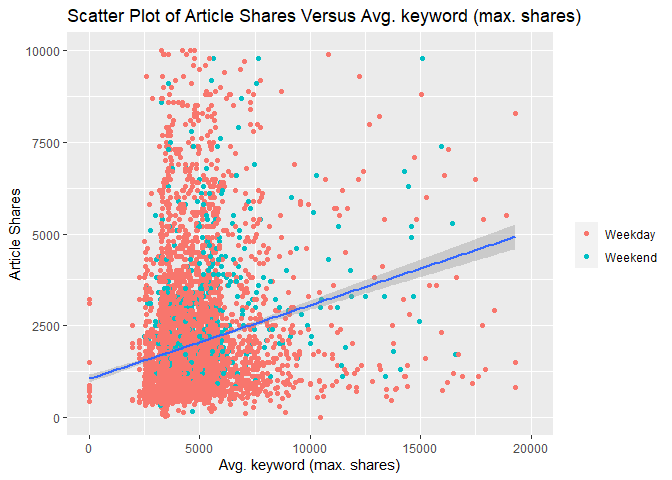

The following two scatterplots illustrate the relationship between

response article shares shares and predictor average keyword (max

shares) kw_max_ave. kw_max_ave was chosen because it was one of the

potential predictors examined in the previous correlation plot.

Both scatterplots plot these variables and add a simple linear regression line to the graph.

For either graph, an upward relationship indicates higher average keyword values tend towards more article shares. A negative relation would indicate a lower average keyword values tend towards more article shares.

In addition, both graphs use differing color for weekday and weekend articles so that we can spot any possible trends with those values too.

The first scatterplot uses the default R generated axes so that potential outliers or significant observations can be observed.

The second scatterplot reduces the scale of both axes to make it easier to spot relationships for the majority of data that occur within these bounds.

###Create new factor version of weekend variable

### to use later in graphs

scatterData<-channelData %>%

mutate(dayType=ifelse(is_weekend,"Weekend","Weekday"))

scatterData$dayType<-as.factor(scatterData$dayType)

###First scatter plot with ALL data

g<-ggplot(data = scatterData,

aes(x= kw_max_avg,y=shares))

g + geom_point(aes(color=dayType)) +

geom_smooth(method = lm) +

scale_y_continuous(labels = scales::comma) +

scale_x_continuous(labels = scales::comma) +

labs(x="Avg. keyword (max. shares)", y="Article Shares",

title = "Scatter Plot of Article Shares Versus Avg. keyword (max. shares)",color="")

###Second scatter plot with reduced axes

g<-ggplot(data = scatterData,

aes(x= kw_max_avg,y=shares))

g + geom_point(aes(color=dayType)) +

geom_smooth(method = lm) +

ylim(0,10000) +

xlim(0,20000) +

labs(x="Avg. keyword (max. shares)", y="Article Shares",

title = "Scatter Plot of Article Shares Versus Avg. keyword (max. shares)",

color="")

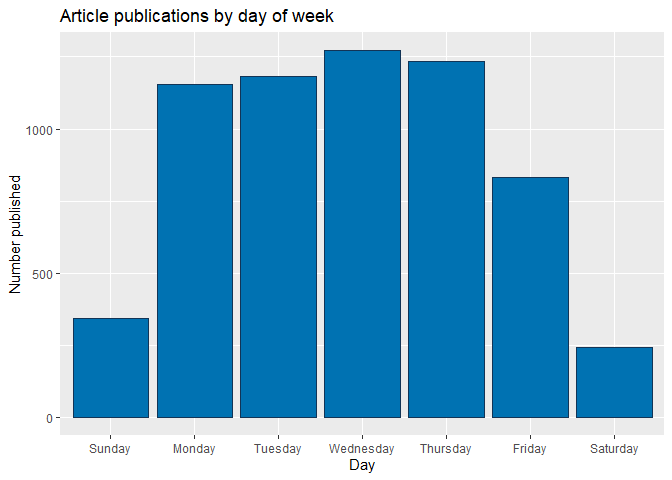

The bar plot below shows cumulative article publications for each day of the week, with higher bars indicating more publications. However, days with the largest number of publications are not necessarily ones with the most article shares, as seen in the subsequent box plot.

# Subset columns to include only weekday_is_*

weekdayData <- channelData %>% select(starts_with("weekday_is"))

# Calculate sum of articles published in each week day

articlesPublished <- lapply(weekdayData, function(c) sum(c=="1"))

# Use factor to set specific order in bar plot

weekPubDF <- data.frame(weekday=c("Monday", "Tuesday", "Wednesday",

"Thursday", "Friday", "Saturday", "Sunday"),

count=articlesPublished)

weekPubDF$weekday = factor(weekPubDF$weekday, levels = c("Sunday", "Monday", "Tuesday", "Wednesday",

"Thursday", "Friday", "Saturday"))

# Create bar plot with total publications by day

weekdayBar <- ggplot(weekPubDF, aes(x = weekday, y = articlesPublished)) + geom_bar(stat = "identity", color = "#123456", fill = "#0072B2")

weekdayBar + labs(x = "Day", y = "Number published",

title = "Article publications by day of week")

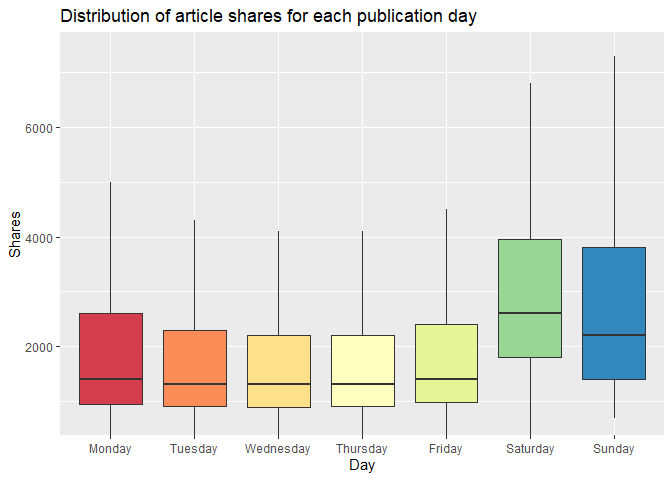

The boxplot below examines the day of article publication

(Monday-Sunday) and the associated distribution of article shares. The

median line indicates the center of the distribution of shares, and

comparatively high medians indicate days that have relatively high

circulation of Mashable articles in social media networks. For days in

which the median is closer to the lower quartile (and where the upper

whisker may be taller than the lower whisker), the distribution is

skewed to the right. Conversely, a median that is closer to the upper

quartile indicates a distribution that is skewed to the left. Days with

relatively taller boxplots also have greater variability of shares.

# Subset columns to include only weekday_is_*, shares,

# create categorical variable, "day", denoting day of week (Mon-Sun)

medianShares <- channelData %>% select(starts_with("weekday_is"), shares) %>% mutate(day = NA)

# Populate "day"

for (i in 1:nrow(medianShares)) {

if (medianShares$weekday_is_monday[i] == 1) {

medianShares$day[i] = "Monday"

}

else if (medianShares$weekday_is_tuesday[i] == 1) {

medianShares$day[i] = "Tuesday"

}

else if (medianShares$weekday_is_wednesday[i] == 1) {

medianShares$day[i] = "Wednesday"

}

else if (medianShares$weekday_is_thursday[i] == 1) {

medianShares$day[i] = "Thursday"

}

else if (medianShares$weekday_is_friday[i] == 1) {

medianShares$day[i] = "Friday"

}

else if (medianShares$weekday_is_saturday[i] == 1) {

medianShares$day[i] = "Saturday"

}

else if (medianShares$weekday_is_sunday[i] == 1) {

medianShares$day[i] = "Sunday"

}

else {

medianShares$day[i] = NA

}

}

# Transform "day" into factor with levels to control order of boxplots

medianShares$day <- factor(medianShares$day,

levels = c("Monday", "Tuesday", "Wednesday",

"Thursday", "Friday", "Saturday", "Sunday"))

# Plot distribution of shares for each day of the week

sharesBox <- ggplot(medianShares, aes(x = day, y = shares, fill = day))

sharesBox + geom_boxplot(outlier.shape = NA) +

# Exclude extreme outliers, limit range of y-axis

coord_cartesian(ylim = quantile(medianShares$shares, c(0.1, 0.95))) +

# Remove legend after coloration

theme(legend.position = "none") +

labs(x = "Day", y = "Shares",

title = "Distribution of article shares for each publication day") + scale_fill_brewer(palette = "Spectral")

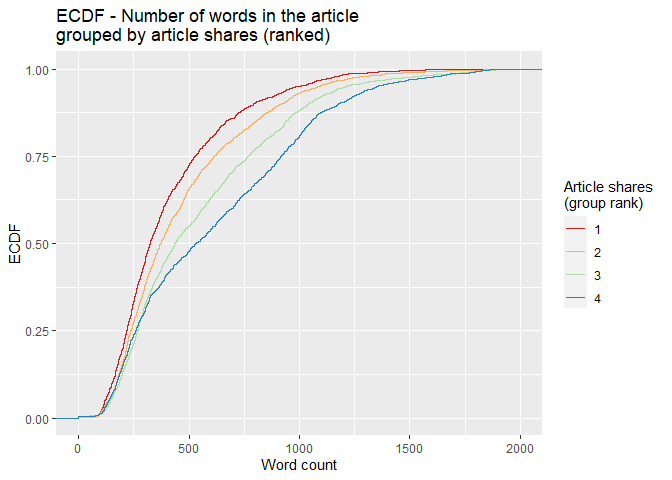

For the empirical cumulative distribution function (ECDF) below, the

dplyr ranking function ntile() divides shares into four groups.

Observations with the fewest shares are placed into group 1, those with

the most shares are placed into group 4, and intermediaries reside in

groups 2 and 3. The horizontal axis lists word count, and the vertical

axis lists the percentage of content with that word count. A divergence

of the colored lines suggests that the number of words differs in

content with the fewest and most shares. At any given percentage of

content (y-value), curves further to the right correspond to more words

within the associated shares group. Groups with curves that are

further to the left indicate fewer words in that percentage of content.

# Create variable to for binning the shares

binnedShares <- channelData %>% mutate(shareQuantile = ntile(channelData$shares, 4))

binnedShares <- binnedShares %>% mutate(totalMedia = num_imgs + num_videos)

# Render and label word count ECDF, group by binned shares

avgWordHisto <- ggplot(binnedShares, aes(x = n_tokens_content, colour = shareQuantile))

avgWordHisto + stat_ecdf(geom = "step", aes(color = as.character(shareQuantile))) +

labs(title="ECDF - Number of words in the article \ngrouped by article shares (ranked)",

y = "ECDF", x="Word count") + xlim(0,2000) +

scale_colour_brewer(palette = "Spectral", name = "Article shares \n(group rank)")

Modeling

Splitting Data

Per project requirements, the data for each channel are split with 70% of the data becoming training data and 30% of the data becoming test data.

#Using set.seed per suggestion so that work will be reproducible

set.seed(20)

dataIndex <-createDataPartition(channelData$shares, p = 0.7, list = FALSE)

channelTrain <-channelData[dataIndex,]

channelTest <-channelData[-dataIndex,]

Linear Regression Models

Linear regression models describe a linear relationship between a response variable and one or more explanatory variables. Models with one explanatory variable are called simple linear regression models and models with more than one explanatory variable are called multiple linear regression models. Multiple linear regression models can include polynomial and interaction terms. Each explanatory variable has an associated estimated parameter. All linear regression models are linear in the parameters.

For linear regression, explanatory variables can be continuous or categorical. However, response variables are only continuous for linear regression models.

Linear regression models are fit with training data by minimizing the sum of squared errors. Model fitting results in a line for simple linear regression and a saddle for multiple linear regression.

The first linear regression model contains predictors that encompass content keywords, sentiment and subjectivity, the length of content (the effects of which were gleaned previously from the ECDF), and link citations.

# Parallel cluster setup

cl <- makePSOCKcluster(6)

registerDoParallel(cl)

# Linear regression with subset of predictors (p-value < 0.1) selected after performing

# least squares fit on the entire set of predictors.

lmFit1 <- train(shares ~ kw_avg_avg + kw_max_avg + kw_min_avg +

num_hrefs + self_reference_min_shares + global_subjectivity +

num_self_hrefs + n_tokens_title + n_tokens_content + n_unique_tokens +

average_token_length + kw_min_max + num_keywords + kw_max_min + abs_title_subjectivity +

global_rate_positive_words,

data = channelTrain,

method = "lm",

preProcess = c("center", "scale"),

trControl = trainControl(method = "cv",

number = 5))

stopCluster(cl)

The second linear regression model contains main effects for most of the

predictors listed earlier in the correlation plot. If variables had more

than .50 pairwise correlation in any channel, one variable of that pair

was excluded. Excluded variables were: self_reference_min_shares,

kw_avg_max, and LDA_01.

cl <- makePSOCKcluster(6)

registerDoParallel(cl)

lmFit2 <- train(shares ~ kw_min_avg +

kw_max_avg + LDA_03 +

self_reference_avg_sharess + LDA_02 +

kw_avg_min + n_non_stop_unique_tokens,

data = channelTrain,

method = "lm",

preProcess = c("center", "scale"),

trControl = trainControl(method = "cv",

number = 10))

stopCluster(cl)

Random Forest Model

Random forest models aggregate results from many sample decision trees. Those sample trees are produced using bootstrap samples created using resampling with replacement. A tree is trained on each bootstrap sample, resulting in a prediction based on that training sample data. Results from all bootstrap samples are averaged to arrive at a final prediction.

Both bagging and random forest methods use bootstrap sampling with decision trees. However, bagging includes all predictors which can lead to less reduction in variance when strong predictors exist. Unlike bagging, random forests do not use all predictors but use a random subset of predictors for each bootstrap tree fit. Random forests usually have a better fit than bagging models.

In this particular case, the response shares is continuous and we are

working with regression trees. The mtry tuning parameter controls how

many random predictors are used in the bootstrap samples. An mtry of 1

to 30 was chosen as a way to evaluate up to 30 predictors. These values

were chosen to work within available computing constraints. Five fold

cross validation is used to choose the optimal mtry value corresponding

to the lowest RMSE.

##Run time presented a challenge so parallel processing was used

##Followed Parallel instructions on caret page

## https://topepo.github.io/caret/parallel-processing.html

##Various mtry values were tried with a 20 minute runtime goal

## A 20 minute per channel runtime corresponds

## to a total of about 2 hours model fit for all 6 channels

##mtry 1:30 was chosen because it was close to 20 minutes

##mtry 1:20 had 10 minute runtime and 1:30 took 30 minutes

##repeatedcv was evaluated but took over 30 minutes

## thus repeats were not used

cl <- makePSOCKcluster(6)

registerDoParallel(cl)

rfFit <- train(shares ~ ., data = channelTrain,

method = "rf",

preProcess = c("center", "scale"),

trControl = trainControl(method = "cv",

number = 5),

tuneGrid = data.frame(mtry = 1:30))

stopCluster(cl)

rfFit

## Random Forest

##

## 4382 samples

## 52 predictor

##

## Pre-processing: centered (52), scaled (52)

## Resampling: Cross-Validated (5 fold)

## Summary of sample sizes: 3506, 3506, 3504, 3506, 3506

## Resampling results across tuning parameters:

##

## mtry RMSE Rsquared MAE

## 1 14890.12 0.03145458 2837.164

## 2 15040.96 0.02933558 2903.931

## 3 15171.47 0.02567270 2933.521

## 4 15335.50 0.02332574 2974.780

## 5 15532.18 0.02025297 2991.222

## 6 15653.58 0.01839011 3023.554

## 7 15677.90 0.01855645 3031.803

## 8 15996.41 0.01622697 3070.579

## 9 15975.03 0.01698446 3080.933

## 10 16042.27 0.01771635 3090.988

## 11 16173.43 0.01588203 3085.666

## 12 16148.39 0.01551689 3100.412

## 13 16119.63 0.01625215 3088.022

## 14 16363.03 0.01455047 3130.017

## 15 16181.99 0.01489809 3120.928

## 16 16251.89 0.01388384 3128.875

## 17 16373.60 0.01431683 3141.608

## 18 16494.23 0.01238045 3154.666

## 19 16413.15 0.01293169 3152.633

## 20 16597.18 0.01249404 3169.338

## 21 16680.73 0.01222214 3170.733

## 22 16402.72 0.01151833 3152.689

## 23 16578.82 0.01358022 3156.448

## 24 16466.51 0.01191402 3168.896

## 25 16567.99 0.01181646 3185.864

## 26 16524.27 0.01221460 3163.637

## 27 16738.15 0.01163398 3193.647

## 28 16837.01 0.01245574 3195.433

## 29 16803.55 0.01211917 3195.775

## 30 16938.78 0.01136888 3210.828

##

## RMSE was used to select the optimal model using the smallest value.

## The final value used for the model was mtry = 1.

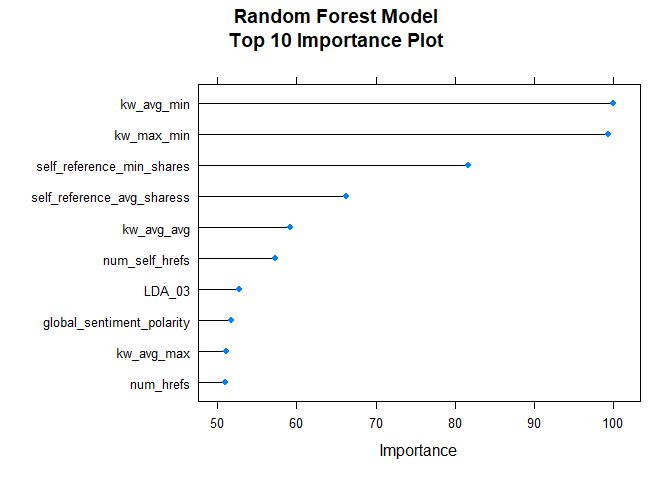

After fitting the random forest model, the following variable importance plot is created. The top ten most important predictors are plotted using a scale of 0 to 100.

rfImp <- varImp(rfFit, scale = TRUE)

plot(rfImp,top = 10, main="Random Forest Model\nTop 10 Importance Plot")

Boosted Tree Model

Boosting is a general method whereby decision trees are grown sequentially using residuals (the differences between observed values and predicted values of a variable) as the response. Initial prediction values start at 0 for all combinations of predictors, so that the first set of residuals matches the observed values in our data. To mitigate low bias and high variance, contributions from subsequent trees are scaled with a shrinkage parameter, λ. The value of this parameter is generally small (0.01 or 0.001), which slows tree growth and tampers overfitting (James et al., 2021).

# Re-allocate cores for parallel computing

cl <- makePSOCKcluster(6)

registerDoParallel(cl)

# Boosted tree fit with tuneLength (let function decide parameter combinations)

boostedTreeFit <- train(shares ~ ., data = channelTrain,

method = "gbm",

preProcess = c("center", "scale"),

trControl = trainControl(method = "cv",

number = 5),

tuneLength = 5)

## Iter TrainDeviance ValidDeviance StepSize Improve

## 1 283409072.2697 nan 0.1000 -83960.4166

## 2 280978872.6293 nan 0.1000 -146705.1979

## 3 279012218.5718 nan 0.1000 -338754.5361

## 4 277061267.4391 nan 0.1000 -469478.7030

## 5 276859225.2438 nan 0.1000 -118503.0608

## 6 275488071.0598 nan 0.1000 -282600.4104

## 7 274290200.1770 nan 0.1000 -650634.8451

## 8 274077262.0476 nan 0.1000 67149.3659

## 9 273787020.2861 nan 0.1000 382104.7027

## 10 273037220.0058 nan 0.1000 -664751.2152

## 20 264986383.8918 nan 0.1000 -341841.7639

## 40 256506148.7169 nan 0.1000 -1703672.3617

## 50 254139580.5369 nan 0.1000 -1073899.6042

# Define tuning parameters based on $bestTune from the permutations above

nTrees <- boostedTreeFit$bestTune$n.trees

interactionDepth = boostedTreeFit$bestTune$interaction.depth

minObs = boostedTreeFit$bestTune$n.minobsinnode

shrinkParam <- boostedTreeFit$bestTune$shrinkage

# Boosted tree fit with defined parameters

bestBoostedTree <- train(shares ~ ., data = channelTrain,

method = "gbm",

preProcess = c("center", "scale"),

trControl = trainControl(method = "cv",

number = 5),

tuneGrid = expand.grid(n.trees = nTrees, interaction.depth = interactionDepth,

shrinkage = shrinkParam, n.minobsinnode = minObs))

## Iter TrainDeviance ValidDeviance StepSize Improve

## 1 282087483.6694 nan 0.1000 -290705.5199

## 2 280380382.6921 nan 0.1000 -519595.0378

## 3 279343194.4944 nan 0.1000 -376257.1922

## 4 278639210.0420 nan 0.1000 -1257722.7860

## 5 278222946.4359 nan 0.1000 -1191411.8982

## 6 276735736.6750 nan 0.1000 997418.0997

## 7 275206863.3175 nan 0.1000 922257.3742

## 8 272916782.4655 nan 0.1000 -459522.7614

## 9 272999070.4616 nan 0.1000 -847294.8887

## 10 270856713.5097 nan 0.1000 -357775.4802

## 20 263415447.8759 nan 0.1000 -1069225.0043

## 40 254738882.2609 nan 0.1000 -810467.6399

## 50 251233557.7684 nan 0.1000 -836015.9677

stopCluster(cl)

Model Comparisons

After models were fit with training data, we do predictions with testing data. Finally, RMSE metrics are extracted and compared. The model with lowest RMSE is presented as the winning model.

# Predict using test data

predictLM1 <- predict(lmFit1, newdata = channelTest)

# Metrics

RMSELM1 <- postResample(predictLM1, obs = channelTest$shares)["RMSE"][[1]]

RMSELM1

## [1] 9683.193

# Store value for model comparison

modelPerformance <- tibble(RMSE = RMSELM1, Model = "Linear regression 1")

predictLM2 <- predict(lmFit2, newdata = channelTest)

RMSELM2<-postResample(predictLM2, channelTest$shares)["RMSE"][[1]]

RMSELM2

## [1] 9707.911

modelPerformance <- add_row(modelPerformance, RMSE = RMSELM2, Model = "Linear regression 2")

predictRF <- predict(rfFit, newdata = channelTest)

RMSERF<-postResample(predictRF, channelTest$shares)["RMSE"]

RMSERF

## RMSE

## 9442.735

modelPerformance <- add_row(modelPerformance, RMSE = RMSERF, Model = "Random forest")

# Predict using test data

predictGBM <- predict(bestBoostedTree, newdata = channelTest)

# Metrics

RMSEGBM <- postResample(predictGBM, obs = channelTest$shares)["RMSE"]

RMSEGBM

## RMSE

## 10295.24

modelPerformance <- add_row(modelPerformance, RMSE = RMSEGBM, Model = "Boosted tree")

# Select row with lowest value of RMSE.

selectModel <- modelPerformance %>% slice_min(RMSE)

selectModel

## # A tibble: 1 x 2

## RMSE Model

## <dbl> <chr>

## 1 9443. Random forest

Based on the preceding analyses with test data, the Random forest model yields the lowest RMSE - 9442.7346433.