Analysis for the Lifestyle Channel

Maks Nikiforov and Mark Austin Due 10/31/2021

##For markdown automation need a different

## image and cache folder

## for each of the 6 channels so that results

## from different channels don't overwrite each other

##Also setting up currentChannel variable

if (params$channel=="data_channel_is_bus") {

knitr::opts_chunk$set(fig.path = "images/bus/",

cache.path = "cache/bus/")

currentChannel<-"Business"

} else if (params$channel=="data_channel_is_entertainment") {

knitr::opts_chunk$set(fig.path = "images/entertainment/",

cache.path="cache/entertainment/")

currentChannel<-"Entertainment"

} else if (params$channel=="data_channel_is_lifestyle") {

knitr::opts_chunk$set(fig.path = "images/lifestyle/",

cache.path = "cache/lifestyle/")

currentChannel<-"Lifestyle"

} else if (params$channel=="data_channel_is_socmed") {

knitr::opts_chunk$set(fig.path = "images/socmed/",

cache.path = "cache/socmed/")

currentChannel<-"Social Media"

} else if (params$channel=="data_channel_is_tech") {

knitr::opts_chunk$set(fig.path = "images/tech/",

cache.path = "cache/tech/")

currentChannel<-"Tech"

} else if (params$channel=="data_channel_is_world") {

knitr::opts_chunk$set(fig.path = "images/world/",

cache.path = "cache/world/")

currentChannel<-"World"

}

Data Import

Data was imported first to allow for a more automated introduction.

# Read all data into a tibble

fullData<-read_csv("./data/OnlineNewsPopularity.csv")

# Eliminate non-predictive variables

reduceVarsData<-fullData %>% select(-url,-timedelta)

#test code for pre markdown automation

#params$channel<-"data_channel_is_bus"

#filter by the current params channel

channelData<-reduceVarsData %>% filter(eval(as.name(params$channel))==1)

# URL data for top ten articles in each category

channelDataURL <- fullData %>% filter(eval(as.name(params$channel))==1)

###Can now drop the data channel variables

channelData<-channelData %>% select(-starts_with("data_channel"))

Introduction

This page offers an exploratory data analysis of Lifestyle articles in the online news popularity data set. The top ten articles in this category, based on the number of shares on social media, include the following titles:

| Shares | Article title |

|---|---|

| 208300 | Obama to Discuss NSA Reform With Lawmakers |

| 196700 | No Movie Trailer Is Complete Without This One Line |

| 139600 | 87% of American Teenagers Send Text Messages Each Month |

| 81200 | High-Tech Wristband Monitors Mood |

| 73100 | 22 Books for Your Ultimate Summer Reading List |

| 56000 | Finalists Exhibit Tech for $465 Million Virtual Border Fence |

| 54900 | Cybersecurity Experts Will Face Off in Mock NetWars |

| 54200 | 84% of Smartphone Owners Use Apps While Getting Ready in the Morning |

| 49700 | It’s Still Easy to Get Away With Revenge Porn |

| 45100 | Beats Solo² Headphones Sound Great, But You’re Paying for Fashion |

Two variables - url and timedelta - are non-predictive and have been

removed. The remaining 53 variables comprise 2099 observations, which

makes up 5.3 percent of the original data set. Fernandes et al., who

sourced the data, concentrated on article characteristics such as

verbosity and the polarity of content, publication day, the quantity of

included media, and keyword attributes (Fernandes et al., 2015). A

subset of these variables and the correlations between them are explored

in subsequent sections.

The broader purpose of this analysis is predicated on using supervised

learning to predict a target variable - shares. To this end, the final

sections outline four unique models for conducting such predictions and

an assessment of their relative performance. Two models are rooted in

multiple linear regression analysis, which assesses relationships

between a response variable and two or more predictors. The remaining

models are based on random forest and boosted tree techniques. The

random forest method averages results from multiple decision trees which

are fitted with a random parameter subset. The boosted tree method

spurns averages in favor of results that stem from weighted iterations

(James et al., 2021).

Summarizations

Numerical Summaries

The first table summarizes information for article shares grouped by

whether an article was a weekend article or not. This summary gives an

idea of the center and spread of shares across type of day group

levels.

channelData %>%

mutate(dayType=ifelse(is_weekend,"Weekend","Weekday")) %>%

group_by(dayType) %>%

summarise(Avg = mean(shares), Sd = sd(shares),

Median = median(shares), IQR =IQR(shares)) %>% kable()

| dayType | Avg | Sd | Median | IQR |

|---|---|---|---|---|

| Weekday | 3628.255 | 9551.749 | 1600 | 2050 |

| Weekend | 3916.696 | 5044.188 | 2100 | 2600 |

The next tables gives expands on the idea of the first table by grouping

shares by each day of the week. This summary gives an idea of the

center and spread of shares across day of the week group levels.

dowData<-channelData %>% select(starts_with("weekday_is"),shares) %>%

mutate(dayofWeek=case_when(as.logical(weekday_is_monday)~"Monday",

as.logical(weekday_is_tuesday)~"Tuesday",

as.logical(weekday_is_wednesday)~"Wednesday",

as.logical(weekday_is_thursday)~"Thursday",

as.logical(weekday_is_friday)~"Friday",

as.logical(weekday_is_saturday)~"Saturday",

as.logical(weekday_is_sunday)~"Sunday")) %>%

select(dayofWeek,shares)

dowLevels<-c("Monday","Tuesday","Wednesday",

"Thursday","Friday","Saturday","Sunday")

dowData$dayofWeek<-factor(dowData$dayofWeek,levels = dowLevels)

dowData %>%

group_by(dayofWeek) %>%

summarise(Avg = mean(shares), Sd = sd(shares),

Median = median(shares), IQR =IQR(shares)) %>% kable()

| dayofWeek | Avg | Sd | Median | IQR |

|---|---|---|---|---|

| Monday | 4345.711 | 14072.938 | 1600 | 2575.00 |

| Tuesday | 4152.494 | 13544.476 | 1500 | 1975.00 |

| Wednesday | 3173.180 | 5608.013 | 1600 | 1800.25 |

| Thursday | 3500.268 | 5820.627 | 1600 | 2250.00 |

| Friday | 3025.869 | 4539.610 | 1500 | 2000.00 |

| Saturday | 4062.451 | 5350.749 | 2100 | 2650.00 |

| Sunday | 3790.376 | 4771.926 | 2100 | 2675.00 |

The table below highlights variables with the highest and most significant correlations in the data set. This output may be considered when analyzing covariance to control for potentially confounding variables.

# Display top 10 highest correlations

covarianceDF <- corr_cross(df = channelData, max_pvalue = 0.05, top = 10, plot = 0) %>%

select(key, mix, corr, pvalue) %>% rename("Variable 1" = key, "Variable 2" = mix,

"Correlation" = corr, "p-value" = pvalue)

# Display non-zero p-values

covarianceDF[4] <- format.pval(covarianceDF[4])

kable(covarianceDF)

| Variable 1 | Variable 2 | Correlation | p-value |

|---|---|---|---|

| kw_max_min | kw_avg_min | 0.956574 | < 2.22e-16 |

| self_reference_max_shares | self_reference_avg_sharess | 0.911916 | < 2.22e-16 |

| n_unique_tokens | n_non_stop_unique_tokens | 0.906660 | < 2.22e-16 |

| n_non_stop_words | average_token_length | 0.870183 | < 2.22e-16 |

| kw_min_min | kw_max_max | -0.856370 | < 2.22e-16 |

| kw_max_avg | kw_avg_avg | 0.818423 | < 2.22e-16 |

| global_rate_negative_words | rate_negative_words | 0.815529 | < 2.22e-16 |

| self_reference_min_shares | self_reference_avg_sharess | 0.787590 | < 2.22e-16 |

| kw_max_max | kw_avg_max | 0.750110 | < 2.22e-16 |

| rate_positive_words | rate_negative_words | -0.731286 | < 2.22e-16 |

Contingency Table

The following contingency table displays counts and sums for the number of article shares within given ranges by the day of week shared. Share ranges were selected to illustrate lower, medium, and higher ranges of shares. Examining these counts can show possible patterns of shares by day or week and the range grouping for shares.

##dig.lab is needed to avoid R defaulting to scientific notation

kable(addmargins(table

(dowData$dayofWeek,cut(dowData$shares,

c(0,200,1000,10000,860000),dig.lab = 7))))

| (0,200] | (200,1000] | (1000,10000] | (10000,860000] | Sum | |

|---|---|---|---|---|---|

| Monday | 3 | 81 | 213 | 25 | 322 |

| Tuesday | 1 | 86 | 229 | 18 | 334 |

| Wednesday | 3 | 106 | 254 | 25 | 388 |

| Thursday | 3 | 87 | 241 | 27 | 358 |

| Friday | 3 | 76 | 210 | 16 | 305 |

| Saturday | 0 | 9 | 156 | 17 | 182 |

| Sunday | 0 | 17 | 180 | 13 | 210 |

| Sum | 13 | 462 | 1483 | 141 | 2099 |

Plots

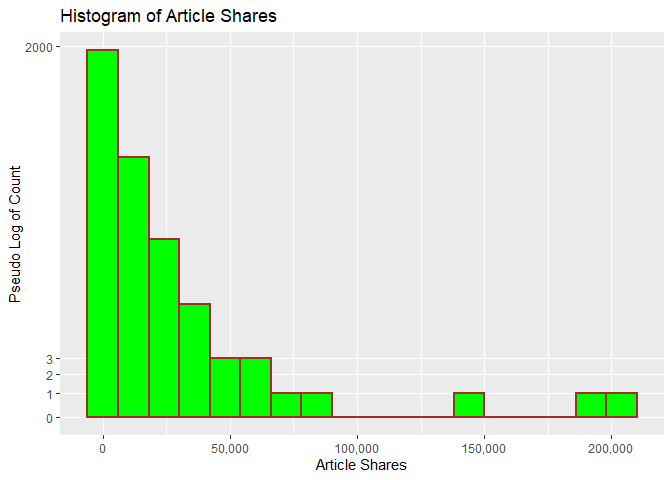

The following histogram looks at the distribution of shares. A pseudo

log y scale with modified y break values was used so that article

shares with low frequency will appear. We can tell from the histogram

whether shares has a symmetric or skewed distribution. The

distribution is symmetric if the tails are the same around the center.

The distribution is right skewed if there is a long left tail and right

skewed if there is a long right tail.

###creating histogram of shares data

##scales comma was used to avoid the default scientific notation

##pseudo log with breaks was used to make low frequency values

## more visisble

g <- ggplot(channelData, aes( x = shares))

g + geom_histogram(binwidth=12000,color = "brown", fill = "green",

size = 1) + labs(x="Article Shares", y="Pseudo Log of Count",

title = "Histogram of Article Shares") +

scale_y_continuous(trans = "pseudo_log",

breaks = c(0:3, 2000, 6000),minor_breaks = NULL) +

scale_x_continuous(labels = scales::comma)

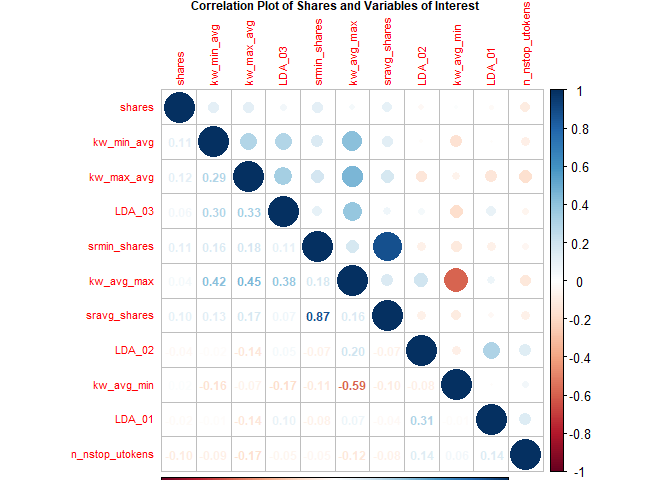

Fernandes et al. highlight several variables in their random forest

model (Fernandes et al., 2015). The following variables from their top

11 were included in the following correlation plot with variables in ()

being renamed for this plot:

shares,kw_min_avg,kw_max_avg,LDA_03,self_reference_min_shares(srmin_shares),kw_avg_max,self_reference_avg_sharess(sravg_shares),LDA_02,kw_avg_min,LDA_01,n_non_stop_unique_tokens(n_nstop_utokens).

The plot shows correlation with the response variable shares and the

other various combinations. Larger circles indicate stronger positive

(blue) or negative (red) correlation with correlation values on the

lower portion of the plot.

##Reduce variable name length for later plotting

## Otherwise var names overwrite Title no matter

## how many other size tweaks were made

corrData<-channelData %>%

mutate(sravg_shares=self_reference_avg_sharess,

srmin_shares=self_reference_min_shares,

n_nstop_utokens=n_non_stop_unique_tokens)

Correlation<-cor(select(corrData, shares, kw_min_avg,

kw_max_avg, LDA_03, srmin_shares,

kw_avg_max, sravg_shares, LDA_02,

kw_avg_min, LDA_01, n_nstop_utokens),

method = "spearman")

corrplot(Correlation,type="upper",tl.pos="lt", tl.cex = .70)

corrplot(Correlation,type="lower",method="number",

add=TRUE,diag=FALSE,tl.pos="n",tl.cex = .70,number.cex = .75,

title =

"Correlation Plot of Shares and Variables of Interest",

mar=c(0,0,.50,0),cex.main = .75)

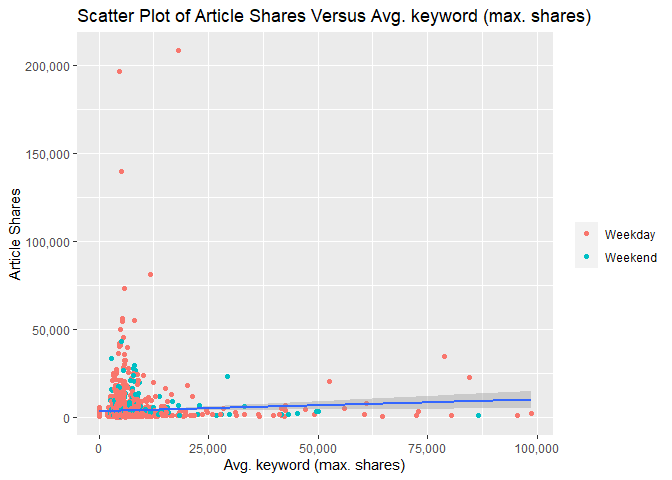

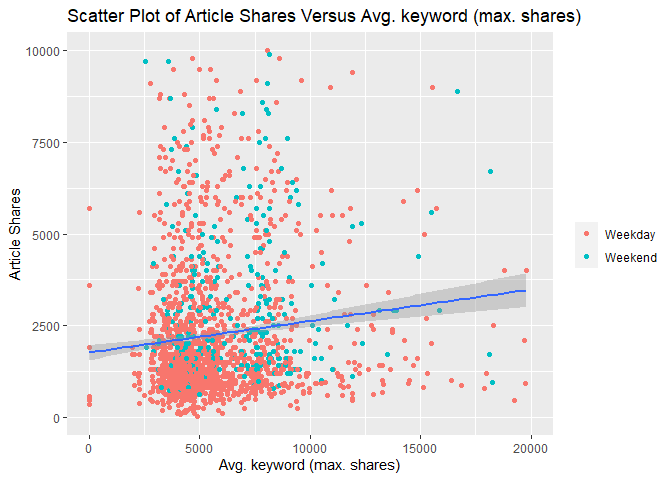

The following two scatterplots illustrate the relationship between

response article shares shares and predictor average keyword (max

shares) kw_max_ave. kw_max_ave was chosen because it was one of the

potential predictors examined in the previous correlation plot.

Both scatterplots plot these variables and add a simple linear regression line to the graph.

For either graph, an upward relationship indicates higher average keyword values tend towards more article shares. A negative relation would indicate a lower average keyword values tend towards more article shares.

In addition, both graphs use differing color for weekday and weekend articles so that we can spot any possible trends with those values too.

The first scatterplot uses the default R generated axes so that potential outliers or significant observations can be observed.

The second scatterplot reduces the scale of both axes to make it easier to spot relationships for the majority of data that occur within these bounds.

###Create new factor version of weekend variable

### to use later in graphs

scatterData<-channelData %>%

mutate(dayType=ifelse(is_weekend,"Weekend","Weekday"))

scatterData$dayType<-as.factor(scatterData$dayType)

###First scatter plot with ALL data

g<-ggplot(data = scatterData,

aes(x= kw_max_avg,y=shares))

g + geom_point(aes(color=dayType)) +

geom_smooth(method = lm) +

scale_y_continuous(labels = scales::comma) +

scale_x_continuous(labels = scales::comma) +

labs(x="Avg. keyword (max. shares)", y="Article Shares",

title = "Scatter Plot of Article Shares Versus Avg. keyword (max. shares)",color="")

###Second scatter plot with reduced axes

g<-ggplot(data = scatterData,

aes(x= kw_max_avg,y=shares))

g + geom_point(aes(color=dayType)) +

geom_smooth(method = lm) +

ylim(0,10000) +

xlim(0,20000) +

labs(x="Avg. keyword (max. shares)", y="Article Shares",

title = "Scatter Plot of Article Shares Versus Avg. keyword (max. shares)",

color="")

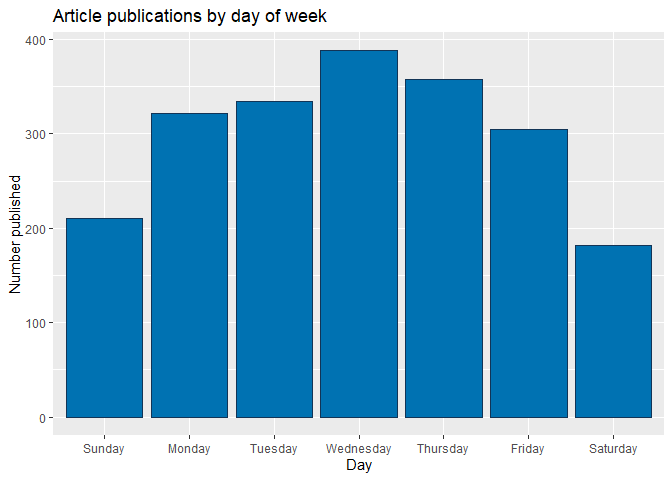

The bar plot below shows cumulative article publications for each day of the week, with higher bars indicating more publications. However, days with the largest number of publications are not necessarily ones with the most article shares, as seen in the subsequent box plot.

# Subset columns to include only weekday_is_*

weekdayData <- channelData %>% select(starts_with("weekday_is"))

# Calculate sum of articles published in each week day

articlesPublished <- lapply(weekdayData, function(c) sum(c=="1"))

# Use factor to set specific order in bar plot

weekPubDF <- data.frame(weekday=c("Monday", "Tuesday", "Wednesday",

"Thursday", "Friday", "Saturday", "Sunday"),

count=articlesPublished)

weekPubDF$weekday = factor(weekPubDF$weekday, levels = c("Sunday", "Monday", "Tuesday", "Wednesday",

"Thursday", "Friday", "Saturday"))

# Create bar plot with total publications by day

weekdayBar <- ggplot(weekPubDF, aes(x = weekday, y = articlesPublished)) + geom_bar(stat = "identity", color = "#123456", fill = "#0072B2")

weekdayBar + labs(x = "Day", y = "Number published",

title = "Article publications by day of week")

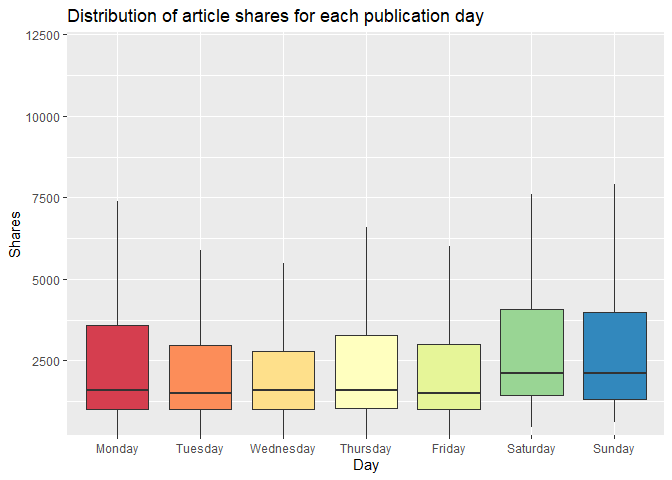

The boxplot below examines the day of article publication

(Monday-Sunday) and the associated distribution of article shares. The

median line indicates the center of the distribution of shares, and

comparatively high medians indicate days that have relatively high

circulation of Mashable articles in social media networks. For days in

which the median is closer to the lower quartile (and where the upper

whisker may be taller than the lower whisker), the distribution is

skewed to the right. Conversely, a median that is closer to the upper

quartile indicates a distribution that is skewed to the left. Days with

relatively taller boxplots also have greater variability of shares.

# Subset columns to include only weekday_is_*, shares,

# create categorical variable, "day", denoting day of week (Mon-Sun)

medianShares <- channelData %>% select(starts_with("weekday_is"), shares) %>% mutate(day = NA)

# Populate "day"

for (i in 1:nrow(medianShares)) {

if (medianShares$weekday_is_monday[i] == 1) {

medianShares$day[i] = "Monday"

}

else if (medianShares$weekday_is_tuesday[i] == 1) {

medianShares$day[i] = "Tuesday"

}

else if (medianShares$weekday_is_wednesday[i] == 1) {

medianShares$day[i] = "Wednesday"

}

else if (medianShares$weekday_is_thursday[i] == 1) {

medianShares$day[i] = "Thursday"

}

else if (medianShares$weekday_is_friday[i] == 1) {

medianShares$day[i] = "Friday"

}

else if (medianShares$weekday_is_saturday[i] == 1) {

medianShares$day[i] = "Saturday"

}

else if (medianShares$weekday_is_sunday[i] == 1) {

medianShares$day[i] = "Sunday"

}

else {

medianShares$day[i] = NA

}

}

# Transform "day" into factor with levels to control order of boxplots

medianShares$day <- factor(medianShares$day,

levels = c("Monday", "Tuesday", "Wednesday",

"Thursday", "Friday", "Saturday", "Sunday"))

# Plot distribution of shares for each day of the week

sharesBox <- ggplot(medianShares, aes(x = day, y = shares, fill = day))

sharesBox + geom_boxplot(outlier.shape = NA) +

# Exclude extreme outliers, limit range of y-axis

coord_cartesian(ylim = quantile(medianShares$shares, c(0.1, 0.95))) +

# Remove legend after coloration

theme(legend.position = "none") +

labs(x = "Day", y = "Shares",

title = "Distribution of article shares for each publication day") + scale_fill_brewer(palette = "Spectral")

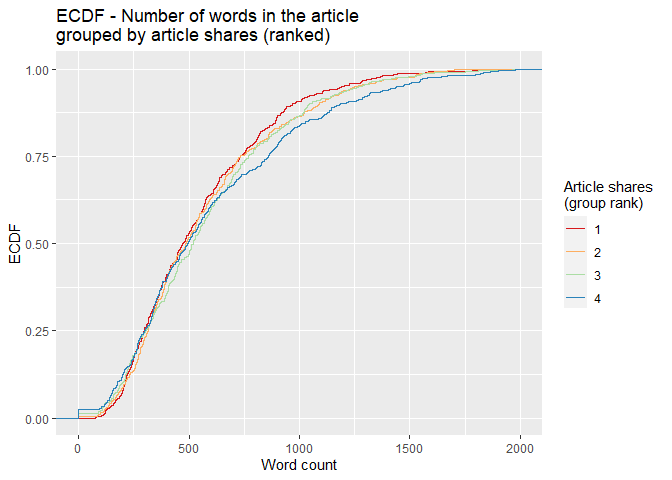

For the empirical cumulative distribution function (ECDF) below, the

dplyr ranking function ntile() divides shares into four groups.

Observations with the fewest shares are placed into group 1, those with

the most shares are placed into group 4, and intermediaries reside in

groups 2 and 3. The horizontal axis lists word count, and the vertical

axis lists the percentage of content with that word count. A divergence

of the colored lines suggests that the number of words differs in

content with the fewest and most shares. At any given percentage of

content (y-value), curves further to the right correspond to more words

within the associated shares group. Groups with curves that are

further to the left indicate fewer words in that percentage of content.

# Create variable to for binning the shares

binnedShares <- channelData %>% mutate(shareQuantile = ntile(channelData$shares, 4))

binnedShares <- binnedShares %>% mutate(totalMedia = num_imgs + num_videos)

# Render and label word count ECDF, group by binned shares

avgWordHisto <- ggplot(binnedShares, aes(x = n_tokens_content, colour = shareQuantile))

avgWordHisto + stat_ecdf(geom = "step", aes(color = as.character(shareQuantile))) +

labs(title="ECDF - Number of words in the article \ngrouped by article shares (ranked)",

y = "ECDF", x="Word count") + xlim(0,2000) +

scale_colour_brewer(palette = "Spectral", name = "Article shares \n(group rank)")

Modeling

Splitting Data

Per project requirements, the data for each channel are split with 70% of the data becoming training data and 30% of the data becoming test data.

#Using set.seed per suggestion so that work will be reproducible

set.seed(20)

dataIndex <-createDataPartition(channelData$shares, p = 0.7, list = FALSE)

channelTrain <-channelData[dataIndex,]

channelTest <-channelData[-dataIndex,]

Linear Regression Models

Linear regression models describe a linear relationship between a response variable and one or more explanatory variables. Models with one explanatory variable are called simple linear regression models and models with more than one explanatory variable are called multiple linear regression models. Multiple linear regression models can include polynomial and interaction terms. Each explanatory variable has an associated estimated parameter. All linear regression models are linear in the parameters.

For linear regression, explanatory variables can be continuous or categorical. However, response variables are only continuous for linear regression models.

Linear regression models are fit with training data by minimizing the sum of squared errors. Model fitting results in a line for simple linear regression and a saddle for multiple linear regression.

The first linear regression model contains predictors that encompass content keywords, sentiment and subjectivity, the length of content (the effects of which were gleaned previously from the ECDF), and link citations.

# Parallel cluster setup

cl <- makePSOCKcluster(6)

registerDoParallel(cl)

# Linear regression with subset of predictors (p-value < 0.1) selected after performing

# least squares fit on the entire set of predictors.

lmFit1 <- train(shares ~ kw_avg_avg + kw_max_avg + kw_min_avg +

num_hrefs + self_reference_min_shares + global_subjectivity +

num_self_hrefs + n_tokens_title + n_tokens_content + n_unique_tokens +

average_token_length + kw_min_max + num_keywords + kw_max_min + abs_title_subjectivity +

global_rate_positive_words,

data = channelTrain,

method = "lm",

preProcess = c("center", "scale"),

trControl = trainControl(method = "cv",

number = 5))

stopCluster(cl)

The second linear regression model contains main effects for most of the

predictors listed earlier in the correlation plot. If variables had more

than .50 pairwise correlation in any channel, one variable of that pair

was excluded. Excluded variables were: self_reference_min_shares,

kw_avg_max, and LDA_01.

cl <- makePSOCKcluster(6)

registerDoParallel(cl)

lmFit2 <- train(shares ~ kw_min_avg +

kw_max_avg + LDA_03 +

self_reference_avg_sharess + LDA_02 +

kw_avg_min + n_non_stop_unique_tokens,

data = channelTrain,

method = "lm",

preProcess = c("center", "scale"),

trControl = trainControl(method = "cv",

number = 10))

stopCluster(cl)

Random Forest Model

Random forest models aggregate results from many sample decision trees. Those sample trees are produced using bootstrap samples created using resampling with replacement. A tree is trained on each bootstrap sample, resulting in a prediction based on that training sample data. Results from all bootstrap samples are averaged to arrive at a final prediction.

Both bagging and random forest methods use bootstrap sampling with decision trees. However, bagging includes all predictors which can lead to less reduction in variance when strong predictors exist. Unlike bagging, random forests do not use all predictors but use a random subset of predictors for each bootstrap tree fit. Random forests usually have a better fit than bagging models.

In this particular case, the response shares is continuous and we are

working with regression trees. The mtry tuning parameter controls how

many random predictors are used in the bootstrap samples. An mtry of 1

to 30 was chosen as a way to evaluate up to 30 predictors. These values

were chosen to work within available computing constraints. Five fold

cross validation is used to choose the optimal mtry value corresponding

to the lowest RMSE.

##Run time presented a challenge so parallel processing was used

##Followed Parallel instructions on caret page

## https://topepo.github.io/caret/parallel-processing.html

##Various mtry values were tried with a 20 minute runtime goal

## A 20 minute per channel runtime corresponds

## to a total of about 2 hours model fit for all 6 channels

##mtry 1:30 was chosen because it was close to 20 minutes

##mtry 1:20 had 10 minute runtime and 1:30 took 30 minutes

##repeatedcv was evaluated but took over 30 minutes

## thus repeats were not used

cl <- makePSOCKcluster(6)

registerDoParallel(cl)

rfFit <- train(shares ~ ., data = channelTrain,

method = "rf",

preProcess = c("center", "scale"),

trControl = trainControl(method = "cv",

number = 5),

tuneGrid = data.frame(mtry = 1:30))

stopCluster(cl)

rfFit

## Random Forest

##

## 1472 samples

## 52 predictor

##

## Pre-processing: centered (52), scaled (52)

## Resampling: Cross-Validated (5 fold)

## Summary of sample sizes: 1178, 1176, 1178, 1177, 1179

## Resampling results across tuning parameters:

##

## mtry RMSE Rsquared MAE

## 1 7700.354 0.011448227 3257.875

## 2 7767.243 0.010557108 3344.202

## 3 7818.160 0.008819996 3361.536

## 4 7863.695 0.008708639 3392.410

## 5 7885.215 0.009835263 3415.104

## 6 7903.022 0.010214064 3396.174

## 7 7989.386 0.009209833 3452.842

## 8 8044.493 0.007095766 3463.653

## 9 8072.146 0.006458376 3464.451

## 10 8133.106 0.006624797 3476.167

## 11 8154.974 0.007672426 3486.552

## 12 8140.628 0.010311884 3481.164

## 13 8151.268 0.009191298 3482.209

## 14 8219.685 0.007071879 3495.295

## 15 8266.071 0.007106738 3499.214

## 16 8272.007 0.007487571 3485.774

## 17 8335.853 0.006336330 3522.780

## 18 8343.314 0.007765418 3525.826

## 19 8403.869 0.007720668 3517.991

## 20 8406.939 0.006405060 3545.463

## 21 8422.275 0.008047622 3516.312

## 22 8451.770 0.006368502 3537.152

## 23 8488.364 0.007367648 3524.590

## 24 8454.638 0.006303017 3522.232

## 25 8526.539 0.007246372 3520.831

## 26 8582.794 0.006213899 3544.972

## 27 8627.369 0.006609938 3544.678

## 28 8647.981 0.006894932 3552.627

## 29 8631.074 0.007435105 3541.756

## 30 8678.797 0.006936974 3545.583

##

## RMSE was used to select the optimal model using the smallest value.

## The final value used for the model was mtry = 1.

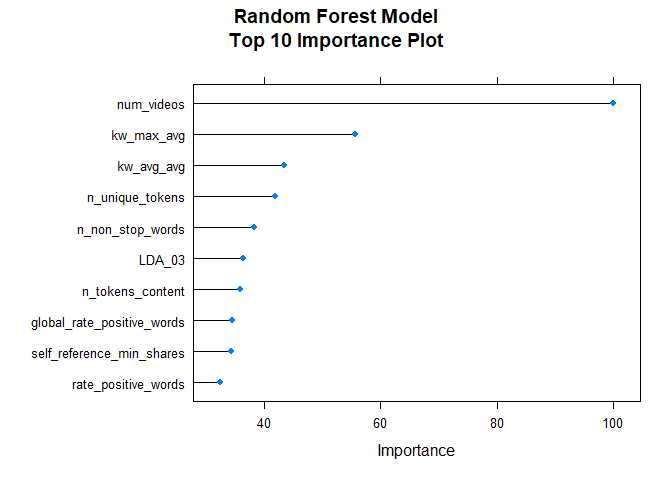

After fitting the random forest model, the following variable importance plot is created. The top ten most important predictors are plotted using a scale of 0 to 100.

rfImp <- varImp(rfFit, scale = TRUE)

plot(rfImp,top = 10, main="Random Forest Model\nTop 10 Importance Plot")

Boosted Tree Model

Boosting is a general method whereby decision trees are grown sequentially using residuals (the differences between observed values and predicted values of a variable) as the response. Initial prediction values start at 0 for all combinations of predictors, so that the first set of residuals matches the observed values in our data. To mitigate low bias and high variance, contributions from subsequent trees are scaled with a shrinkage parameter, λ. The value of this parameter is generally small (0.01 or 0.001), which slows tree growth and tampers overfitting (James et al., 2021).

# Re-allocate cores for parallel computing

cl <- makePSOCKcluster(6)

registerDoParallel(cl)

# Boosted tree fit with tuneLength (let function decide parameter combinations)

boostedTreeFit <- train(shares ~ ., data = channelTrain,

method = "gbm",

preProcess = c("center", "scale"),

trControl = trainControl(method = "cv",

number = 5),

tuneLength = 5)

## Iter TrainDeviance ValidDeviance StepSize Improve

## 1 81592531.7691 nan 0.1000 -110219.7078

## 2 81125745.4982 nan 0.1000 -171529.4904

## 3 81064940.7366 nan 0.1000 -41573.2315

## 4 80930623.3187 nan 0.1000 138028.7523

## 5 80553322.6423 nan 0.1000 -87917.9221

## 6 80288738.6406 nan 0.1000 -126909.0245

## 7 80070259.2664 nan 0.1000 -264937.3073

## 8 79967993.4034 nan 0.1000 -82901.7624

## 9 79932628.1262 nan 0.1000 -47379.8320

## 10 79723983.2571 nan 0.1000 -52377.8386

## 20 78302534.7038 nan 0.1000 -285124.4793

## 40 77803375.1027 nan 0.1000 -223603.4316

## 50 77553134.0175 nan 0.1000 -415020.9452

# Define tuning parameters based on $bestTune from the permutations above

nTrees <- boostedTreeFit$bestTune$n.trees

interactionDepth = boostedTreeFit$bestTune$interaction.depth

minObs = boostedTreeFit$bestTune$n.minobsinnode

shrinkParam <- boostedTreeFit$bestTune$shrinkage

# Boosted tree fit with defined parameters

bestBoostedTree <- train(shares ~ ., data = channelTrain,

method = "gbm",

preProcess = c("center", "scale"),

trControl = trainControl(method = "cv",

number = 5),

tuneGrid = expand.grid(n.trees = nTrees, interaction.depth = interactionDepth,

shrinkage = shrinkParam, n.minobsinnode = minObs))

## Iter TrainDeviance ValidDeviance StepSize Improve

## 1 81970919.4694 nan 0.1000 33269.3045

## 2 81544792.4778 nan 0.1000 -44965.6893

## 3 80990983.9297 nan 0.1000 12946.2311

## 4 80710153.3339 nan 0.1000 -61735.7828

## 5 80505886.1632 nan 0.1000 -84920.5351

## 6 80223864.9008 nan 0.1000 -102302.6449

## 7 79996735.8107 nan 0.1000 -176239.8212

## 8 79791678.7133 nan 0.1000 -92517.9657

## 9 79674421.6124 nan 0.1000 -114856.9453

## 10 79455266.6071 nan 0.1000 -144634.3177

## 20 78447467.1908 nan 0.1000 -46217.4624

## 40 77584239.2316 nan 0.1000 -154797.5720

## 50 76942816.5418 nan 0.1000 210463.3425

stopCluster(cl)

Model Comparisons

After models were fit with training data, we do predictions with testing data. Finally, RMSE metrics are extracted and compared. The model with lowest RMSE is presented as the winning model.

# Predict using test data

predictLM1 <- predict(lmFit1, newdata = channelTest)

# Metrics

RMSELM1 <- postResample(predictLM1, obs = channelTest$shares)["RMSE"][[1]]

RMSELM1

## [1] 8344.936

# Store value for model comparison

modelPerformance <- tibble(RMSE = RMSELM1, Model = "Linear regression 1")

predictLM2 <- predict(lmFit2, newdata = channelTest)

RMSELM2<-postResample(predictLM2, channelTest$shares)["RMSE"][[1]]

RMSELM2

## [1] 8450.339

modelPerformance <- add_row(modelPerformance, RMSE = RMSELM2, Model = "Linear regression 2")

predictRF <- predict(rfFit, newdata = channelTest)

RMSERF<-postResample(predictRF, channelTest$shares)["RMSE"]

RMSERF

## RMSE

## 8415.603

modelPerformance <- add_row(modelPerformance, RMSE = RMSERF, Model = "Random forest")

# Predict using test data

predictGBM <- predict(bestBoostedTree, newdata = channelTest)

# Metrics

RMSEGBM <- postResample(predictGBM, obs = channelTest$shares)["RMSE"]

RMSEGBM

## RMSE

## 8503.737

modelPerformance <- add_row(modelPerformance, RMSE = RMSEGBM, Model = "Boosted tree")

# Select row with lowest value of RMSE.

selectModel <- modelPerformance %>% slice_min(RMSE)

selectModel

## # A tibble: 1 x 2

## RMSE Model

## <dbl> <chr>

## 1 8345. Linear regression 1

Based on the preceding analyses with test data, the Linear regression 1 model yields the lowest RMSE - 8344.9359123.